Advantages of a Small Down Payment When deciding how much to put down for your new house, there are a few key things to focus on. There are several advantages to making a large down payment including lower mortgage payments, and avoiding additional interest… But, there are a lot of advantage to making a small […]

Category Archives: buying

Pros and Cons to Making a Large Down Payment

Should You Make a Large Down Payment on a House? For some people this is a no-brainer… If you’re scraping together every last quarter you can find under the sofa cushions, then your bank account has already told you how much you can put down. But if you’re in the position to make a large […]

Appraised Value or Market Value, Which is Right?

The question of what a home is actually worth is the driving force of every real estate transaction. The negotiations about price and repairs, the managing of multiple offers for the best outcome, the buyer’s ability to obtain financing, and even insurance quotes all come back to determining the true value of a property. A […]

7 Tips for Getting a Seller to Accept Your Offer

If you are a buyer in today’s seller’s market, you know just how tough it is out there. There are simply more buyers than there are homes for sale, which can make the process of finding and buying a home incredibly difficult. Some houses are going under contract within hours of being listed for sale, […]

3 Important Things to Look for on a Preliminary Title Report

Ahh yes, the infamous Preliminary Title Report, or as we call it in the biz: The Prelim. This is one of the many documents in a real estate transaction that is meant to disclose all significant knowledge of a property’s current condition to the buyer. The prelim, however, is one of the most important disclosures. […]

How To Determine Home Value Using Comps

One of the most important decisions you’ll make when selling your house is what price to list it at. If you are serious about getting offers and selling your house, than you should pick a price that is close to the expected market value of your home. 7 tips for evaluating and negotiating multiple offers […]

Know What Title Insurance Policy You Are Getting: CLTA vs ALTA

Title insurance protects a title holder from some pretty scary potential problems. When buying or selling a house in California it is pretty common to be required to buy title insurance, but there is an exception or two. In most transactions there are 2 title policies that need to be purchased: The owner’s title policy, […]

What’s Happening to Home Prices in 2017?

The median sales price of homes steadily increased throughout 2016 and into 2017. This of course was no surprise, as I discussed about a year ago. What would be a surprise though (at least to me) is if prices continued to increase into 2018. So what happens next? Let us speculate… First, I just need […]

Just a Nutty Thing That Happened…

I couldn’t believe what had just happened! A few days ago I had just finished showing my new clients some homes. We had just finished our last stop of the day and were standing out on the sidewalk in front of the home talking about the pros and cons of everything we had just seen. It was […]

FHA Loans vs. Conventional

What is an FHA Loan An FHA loan is simply a loan that is insured by the Federal Housing Administration (“FHA”). Basically, the FHA promises lenders that if they make loans to borrowers according to certain guidelines, then FHA will guarantee the loan. So, if the borrower defaults on the loan, FHA will reimburse the […]

What is the Federal Housing Administration

What is FHA? FHA stands for the Federal Housing Administration. It is a government organization that provides insurance on loans to protect FHA approved lenders. Because FHA helps reduce the risk to lenders, they are willing to make loans to people that they may have otherwise not been willing to. Lower credit and income requirements mean […]

How Buying a House Will Save You Money on Your TAXES

Tax Benefits of Buying a House Have you ever had someone tell you that you need to own your own home. Maybe it was your parents, grandparents, or financial adviser that came to you and said that you are losing out by not buying. Well, they are probably right. Of course, there are both pros […]

Do You Really Need to Buy Title Insurance?

Do I need to get Title Insurance? Buying a house is BIG DEAL, and it is usually pretty expensive too. Sometimes cash-strapped buyers start looking for expenses they can live without in order to save some money. One of the first line items they might look at is Title Insurance, and wonder “Do I really […]

6 Real Estate Title Issues

Common Title Prolems in Real Estate Title issues are not uncommon in real estate, and if you are not careful they can often cost you a lot of time, stress and money. Just defining what title means for a certain property can be complicated, but there are a wide variety of other factors that can have […]

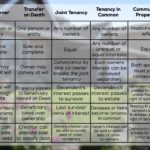

How to Hold Title in California

Vesting in Real Estate Whenever a property is transferred from one owner to another in California, a “Deed” must be filed with the county. This document not only describes who the new owners are, but how they are holding title, which is referred to as title vesting. Title Vesting Definition So what is the definition […]